Your

Journey

Our

Process

Insurance

Planning

Estate

Planning

Education

Funding

Asset Management

Retirement Planning

Our

Services

Financial Planning

Our

People

Home

GETTING THERE IS A PROCESS

HOW THE INVESTMENT CONSULTING PROCESS WORKS

Our disciplined process is designed to help guide you throughout your investing lifetime. As an investor, you want to make sure your entire team is committed to achieving your goals. We coordinate your team of investment professionals, which may include portfolio strategists and investment management firms.

INTRODUCTION

to the consulting process

DISCOVERY

of your goals and risk profile

PROPOSAL

for your consideration

IMPLEMENTATION

of your investment plan

PERIODIC REVIEW

of your investment holdings and performance

PROGRESS MONITORING

focused on your individual goals

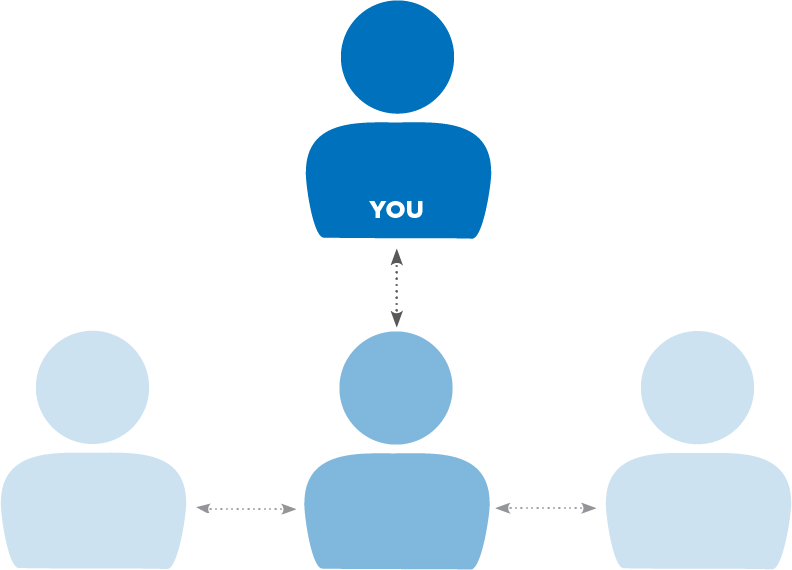

INVESTMENT MANAGERS

- Research and identify opportunities in their specific area of expertise

- Maintain a disciplined investment process and consistent investment style

ROBERT E. LEGER, CLU, ChFC

- Evaluate your individual situation

- Assemble and monitor the mix of strategies and investment professionals

- Monitor your portfolio(s) and rebalance your portfolio(s) as needed

- Communicate with you regularly

PORTFOLIO STRATEGISTS

- Determine a broad mix of asset classes that best represents their strategy and your risk/return profile at any point in time

- Reallocate and rebalance their strategy to keep it aligned with your goals

HOW WE WORK WITH YOU

Your First Meeting With Us is Complementary

During our initial meeting we define our roles and responsibilities, how we work, and what we charge. We learn about your history, beliefs, priorities and preferences. It can be difficult to talk about money and the future. We offer tools that bring to light the challenges you face and the goals you have for your life. This process is vital to establish a basis for a mutually beneficial relationship.

The Discovery

We ask you to complete questionnaires and provide copies of relevant documents so we can review your current financial situation, and to establish goals and objectives as well as time horizons and potential outcomes. We need to identify your current investments and evaluate your risk profile. We evaluate your risk profile from multiple perspectives including your required risk, your perception of risk, your risk tolerance, and your capacity for risk.

Analyze Your Financial Situation

We assess your financial strengths and weaknesses. How’s your cash flow? Are you saving enough? What is your net worth? How are your current assets invested? What fees are you paying? Do you have the right asset allocation given your objectives, time horizons, and risk profile? What financial gaps need to be mitigated?

Create a Strategy by Evaluating Your Alternatives

There is seldom only one way to achieve an objective. We work with you to evaluate the relative strengths of each option and allow you to express your personal perspective and preferences.

Develop a Formal Financial Plan

We may present multiple courses of action. Your plan will reflect your unique situation and lay out strategies to help you work towards reaching your goals. Strategies may include retirement planning, risk management, education funding, estate planning, cash flow management and tax planning.**

Implement Your Financial Plans

We counsel you in carrying out our recommendations and taking the next steps. We keep you informed and provide coaching and support as needed. We are always available to help you respond to life changes and evaluate how they might affect your finances. We believe in low cost globally diversified portfolios that incorporate both active and passive investment management styles. We manage your funds on a discretionary basis or refer the management of your assets to one or more strategists.

Monitor Your Plans

We review your investment account(s) on a regular basis and provide you with quarterly performance reports. We simultaneously monitor your progress towards your goals. We make ourselves available to you at convenient times and require an annual face-to-face meeting.

ABOUT INVESTMENT ADVISOR REPRESENTATIVES

Investment Advisor Representatives are considered fiduciaries. The fiduciary duty requires an investment adviser, by law, to act in the best interest of their clients, putting clients’ interests ahead of their own at all times. Under the fiduciary duty, an investment adviser must provide advice and investment recommendations they view as being in the best interest of the client. In addition to being obligated to put clients’ interests ahead of their own, fiduciaries must also adhere to the duties of loyalty and care. An investment adviser, subject to the fiduciary duty, is required to provide up-front disclosures to the client, before any contracts are signed to provide investment advice. They cover important topics such as the investment adviser’s qualifications, services provided, compensation, range of fees, methods of analysis, record of any disciplinary actions and possible conflicts of interest. An investment adviser who has a material conflict of interest must either eliminate that conflict or fully disclose to his or her clients all material facts relating to that conflict.

**Representatives of Woodbury Financial Services, Inc. do not provide tax or legal advice. Please consult your tax advisor or attorney for such guidance.

THE PROCESS

Discover

Analyze

Strategize

Formalize

Implement

Monitor

Contact

Us